[ad_1]

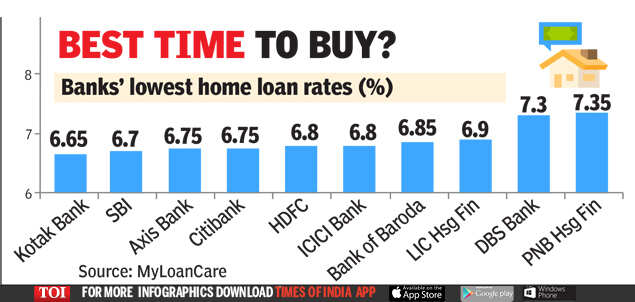

SBI now offers home loans of up to Rs 75 lakh for as low as 6.7% (to women salaried borrowers) — the cheapest rate ever offered by the bank. SBI also continues to waive processing fees on all home loan applications. Kotak Mahindra Bank said that it would offer home loans for rates starting at 6.65% for both new purchases and balance transfers — also its lowest rate ever.

Home loans are the only drivers of credit growth for banks and lenders are expecting a jump in the last month as some of the schemes offered by state authorities, such as relaxation on stamp duty, end in March. While Kotak Bank’s rate is lower than SBI, it has a much smaller distribution footprint compared to the country’s largest bank and is a relatively smaller player in home loans.

“The earlier best rate was 6.8%, and now it is 6.7%. Earlier, there were three slabs, including one for loans up to Rs 30 lakh. Now we have one rate for loans up to Rs 75 lakh and another for larger loans,” said SBI deputy MD (retail business) Saloni Narayan.

“A person with a credit score of 775 will get home loans at 6.8%. If they source the loan through Yono, there is a further 5bps discount. If the borrower is a woman, the rate will be a further 5bps lower at 6.7%,” she said. These rates are applicable to salaried borrowers, and there is a small premium for non-salaried borrowers.

SBI announced its offer on the day it crossed the milestone of Rs 1-lakh-crore disbursement of home loans in FY21. The total home loan portfolio was Rs 5 lakh crore as on January 31. “We should end the year at Rs 5.12 lakh crore. Year on year we have grown 10%, and the number of loans disbursed month on month have increased with up to 1,300 proposals a day being processed,” Narayan added.

The bank plans to increase disbursement of home loans by reducing the current turnaround time of five days where there is a builder tie-up, and also reduce the 12-day timeline for when there is no such tie-up.

“We are rolling out a retail loan management system next month and improving the strength of loan-sourcing teams,” said Narayan. She added that the bank was going the omni-channel way to distribute home loans by giving customers the option to seek loans through missed calls, through branches, online or through representatives.

[ad_2]

Source link

Leave a Reply